Top 10 Hard Skills Employers Love

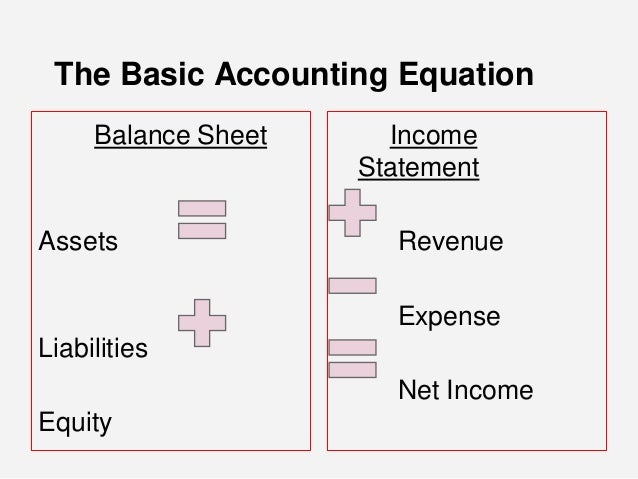

According to me contra entry means the entry which effect the both side of cash book. For when we deposited cash into bank there on debit side we pass the entry we debited bank acount from cash account and on credit side we credited cash account from bank acount. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received.

By getting into the habit of entering all of the day’s business transactions into his computer, Joe will be rewarded with fast and easy access to the specific information he will need to make sound business decisions. Marilyn tells Joe that accounting’s “transaction approach” is useful, reliable, and informative. She has worked with other small business owners who think it is enough to simply “know” their company made $30,000 during the year (based only on the fact that it owns $30,000 more than it did on January 1). Those are the people who start off on the wrong foot and end up in Marilyn’s office looking for financial advice. The company records any expenses when they’re incurred, even if it hasn’t paid for the supplies yet.

In cash-basis accounting, companies record expenses in financial accounts when the cash is actually laid out, and they book revenue when they actually hold the cash in their hot little hands or, more likely, in a bank account. For example, if a painter completed a project on December https://accountingcoaching.online/present-value-of-a-single-amount/ 30, 2003, but doesn’t get paid for it until the owner inspects it on January 10, 2004, the painter reports those cash earnings on her 2004 tax report. In cash-basis accounting, cash earnings include checks, credit-card receipts, or any other form of revenue from customers.

Revenue Recognition Principle

Each category can be further broken down into several categories. Business transactions are events that have a monetary impact on the financial statements of an organization.

In cash accounting, the company doesn’t record the liability until it actually pays the government the cash. Although the company incurs tax expenses each month, the accounts receivable example company using cash accounting shows a higher profit during two months every quarter and possibly even shows a loss in the third month when the taxes are paid.

This lesson will cover how to create journal entries from business transactions. Nonprofit accounting Journal entries are the way we capture the activity of our business.

just simple question .wat are the three golden rules of accounts?

For example, when a carpenter buys lumber for a job, he may very likely do so on account and not actually lay out the cash for the lumber until a month or so later when he gets the bill. DebitCreditUtilities Expense1,200Cash1,200All the journal entries illustrated so far have involved one debit and one credit; these journal entries are calledsimple journal entries. Many business transactions, however, affect more than two accounts. The journal entry for these transactions involves more than one debit and/or credit. Double-entry bookkeeping, in accounting, is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account.

Accounting Basics (Explanation)

Because the cash book is updated continuously, it will be in chronological order by the transaction. In the description column, the accountant writes a short description retained earnings normal balance or narration of the transaction. In the reference or ledger folio column, the accountant inputs the account number for the related general ledger account.

If he uses the cash-basis accounting method, because no cash changes hands, the carpenter doesn’t have to report any revenues from this transaction in 2004. In this case, his bottom line is $1,200 less with no revenue to offset it, and his net profit (the amount of money the company earned, minus its expenses) for the business in 2004 is lower.

There is no upper limit to the number of accounts involved in a transaction – but the minimum is no less than two accounts. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. If the same carpenter uses accrual accounting, his bottom line is different.

- In cash-basis accounting, cash earnings include checks, credit-card receipts, or any other form of revenue from customers.

- In cash-basis accounting, companies record expenses in financial accounts when the cash is actually laid out, and they book revenue when they actually hold the cash in their hot little hands or, more likely, in a bank account.

That is, the company records revenue when it earns it, even if the customer hasn’t paid yet. For example, a carpentry contractor who uses accrual accounting records the revenue earned when he completes the job, even if the customer hasn’t paid the final bill yet. A contra entry is recorded when the debit and credit affect the same parent account and resulting in a net zero effect to the account. These are transactions that are recorded between cash and bank accounts.

When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. It includes details about debits and https://accountingcoaching.online/ credits, assets, liabilities, sales and expenses. Examples are provided and a quick description of the chart of accounts, profit and loss statements and the balance sheet is also included.

What are the 3 golden rules of accounting?

In 1494, the first book on double-entry accounting was published by Luca Pacioli. Since Pacioli was a Franciscan friar, he might be referred to simply as Friar Luca. While Friar Luca is regarded as the “Father of Accounting,” he did not invent the system.

The amount of the transaction is recorded in the final column. specially use for either cash deposite in bank or cash withdraw from bank. in these, accounting entry are recorded in to both debit and credit side of cashbook is known as contra entry.

In this case, he books his expenses when they’re actually incurred. He also records the income when he completes the job on December 31, 2004, even though he doesn’t get the cash payment until 2005. His net income is increased by this job, and so is his tax hit.

What are the 5 accounting principles?

Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions.

You will also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company’s income statement reports a company’s profitability. The way a company records payment of payroll taxes, for example, differs with these two methods. The entry goes into a tax liability account (an account for tracking tax payments that have been made or must still be made). If the company incurs $1,000 of tax liabilities in March, that amount is entered in the tax liability account even if it hasn’t yet paid out the cash.

This scenario may not necessarily be a bad thing if he’s trying to reduce his tax hit for 2004. A cash book is a separate ledger in which cash transactions are recorded, whereas a cash account is an account within a general ledger. A cash book serves the purpose of both the journal and ledger, whereas a cash account is structured https://accountingcoaching.online/ like a ledger. Details or narration about the source or use of funds are required in a cash book but not in a cash account. Whenever an accounting transaction is created, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry being recorded against the other account.

There are numerous reasons why a business might record transactions using a cash book instead of a cash account. Mistakes can be detected easily through verification, and entries are kept up-to-date since the balance is verified daily. With cash accounts, balances are commonly reconciled at the end of the month after what is bookkeeping the issuance of the monthly bank statement. Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions.